fintechzoom amc stock In the ever-evolving landscape of finance and technology, few narratives have captured the public’s imagination as vividly as the saga of fintechzoom amc stock Entertainment Holdings Inc. (AMC). This tale intertwines the traditional world of cinema with the dynamic forces of financial technology, or fintech, exemplified by platforms like FintechZoom. In this comprehensive exploration, we’ll delve into the intricate relationship between FintechZoom and AMC stock, providing insights that cater to both novice investors and seasoned market enthusiasts.

Understanding fintechzoom amc stock : A Modern Financial Platform

Before we delve into AMC’s stock specifics, it’s essential to grasp what fintechzoom amc stock brings to the table. FintechZoom is a contemporary financial analytics platform renowned for offering traders real-time data, comprehensive stock analysis, and insightful market perspectives. Its user-friendly interface and advanced tools make it a go-to resource for investors aiming to navigate the complexities of today’s financial markets.

Key Features of fintechzoom amc stock

- Real-Time Data: fintechzoom amc stock provides up-to-the-minute stock price updates, ensuring investors have the latest information at their fingertips.

- Advanced Charting Tools: The platform offers interactive charts with customizable indicators, allowing users to analyze stock performance over various timeframes.

- Expert Analysis: fintechzoom amc stock aggregates insights from industry experts, providing in-depth commentary and analysis on market trends.

- Customizable Alerts: Investors can set personalized alerts for specific stocks, ensuring they never miss critical market movements.

- Educational Resources: For those new to investing, fintechzoom amc stock offers tutorials and learning materials to help users understand market dynamics and investment strategies.

AMC Entertainment Holdings Inc.: A Cinematic Giant

fintechzoom amc stock Entertainment Holdings Inc., commonly known as AMC, stands as one of the world’s largest movie theater chains. With a rich history in the cinema industry, AMC has been a cornerstone of the movie-going experience for decades. However, recent years have seen the company at the center of unprecedented market dynamics, transforming it into a focal point for investors and analysts alike.

A Brief History of fintechzoom amc stock

Founded in 1920, fintechzoom amc stock has grown to operate over 900 theaters and more than 10,000 screens globally. The company has been a pioneer in introducing innovations like stadium seating and recliner chairs, enhancing the movie-going experience. Despite its longstanding presence, AMC faced significant challenges during the COVID-19 pandemic, which forced theater closures and threatened its financial stability.

The Rise of fintechzoom amc stock as a “Meme Stock”

In 2021, AMC became emblematic of the “meme stock” phenomenon, where retail investors, often coordinating on social media platforms like Reddit’s WallStreetBets, drove up the stock prices of certain companies, defying traditional market expectations.

The Power of Retail Investors

Retail investors banded together to purchase AMC shares en masse, leading to dramatic increases in stock price. This collective action was often motivated by a desire to challenge institutional investors and capitalize on short squeezes.

Impact on fintechzoom amc stock Stock Price

The surge in retail investment led to unprecedented volatility in AMC’s stock price. At its peak, the stock experienced significant gains, capturing the attention of media and market analysts worldwide.

fintechzoom amc stock Role in AMC Stock Analysis

fintechzoom amc stock emerged as a vital tool for investors seeking to understand and navigate the complexities of AMC’s stock movements during this tumultuous period.

Providing Real-Time Market Data

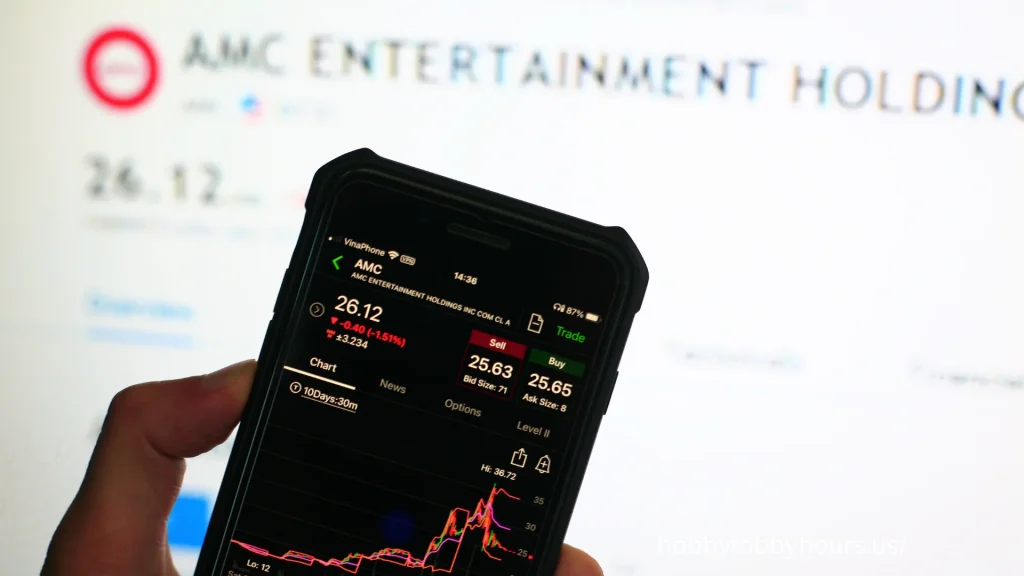

fintechzoom amc stock offered real-time updates on fintechzoom amc stock stock price, trading volume, and market capitalization, enabling investors to make informed decisions in a rapidly changing environment.

In-Depth Analytical Tools

The platform’s advanced charting tools and technical indicators allowed users to perform detailed analyses of AMC’s stock performance, identifying trends and potential investment opportunities.

Aggregating Expert Insights

By compiling analyses from financial experts, FintechZoom provided users with diverse perspectives on AMC’s market position, financial health, and future prospects.

Analyzing fintechzoom amc stock Financial Health

Understanding AMC’s financial standing is crucial for investors considering involvement with the stock. Key aspects to consider include revenue trends, debt levels, and cash flow.

Revenue Trends and Growth Prospects

AMC’s revenue was significantly impacted by the pandemic due to theater closures and reduced attendance. However, with the gradual reopening of economies and the release of blockbuster films, there has been a notable recovery. The company’s initiatives to enhance the movie-going experience, such as upgrading theaters and offering premium formats, aim to attract audiences back to cinemas.

Debt Levels and Liabilities

AMC has historically carried substantial debt, a factor that has raised concerns among investors. The company has undertaken measures to manage its liabilities, including restructuring debt and issuing new equity. Notably, fintechzoom amc stock entered an agreement with Goldman Sachs to sell up to 50 million shares of Class A common stock, intending to strengthen its balance sheet and reinvest in its core business.

Cash Flow and Profitability

Positive cash flow is essential for AMC to sustain operations and invest in growth initiatives. The company’s focus on improving operational efficiency and exploring alternative revenue streams, such as partnerships with streaming services, is aimed at enhancing profitability.

Factors Influencing fintechzoom amc stock Price

Several elements contribute to the volatility and performance of AMC’s stock.

Market Sentiment and Social Media Influence

Social media platforms have played a pivotal role in shaping market sentiment toward AMC. Discussions and campaigns on forums like Reddit have led to rapid changes in stock price, driven by collective retail investor actions.

Industry Trends and Competition

The rise of streaming services poses a significant challenge to traditional cinema chains. AMC’s ability to adapt to changing consumer preferences and differentiate its offerings will be critical in maintaining its market position.

Economic Indicators

Broader economic factors, such as consumer spending patterns, inflation rates, and employment levels, can impact fintechzoom amc stock performance. Economic downturns may reduce discretionary spending, affecting theater attendance.

Investment Strategies for AMC Stock

Investors may consider various approaches when engaging with AMC stock, each aligned with different risk tolerances and investment horizons.

Long-Term Investment

For those with a long-term perspective, investing in fintechzoom amc stock may involve betting on the company’s ability to recover and grow post-pandemic. This strategy requires confidence in AMC’s management and its plans to innovate and remain competitive in the evolving entertainment landscape.

Short-Term Trading

Short-term traders might seek to capitalize on the stock’s volatility, leveraging real-time data and technical analysis tools provided by platforms like fintechzoom amc stock to identify entry and exit points.